Global Shrimp Markets: Looking Beyond The Pandemic

| Mon, 25 Jan 2021 - 16:48

On September 24-25, the Society of Aquaculture Professionals (SAP), India organised a 2-day webinar on “Global Shrimp Markets: Looking Beyond the Pandemic”. In a press release, Dr Arul Victor Suresh, SAP President said, "In March, when we had our first lockdown, while shrimp farmers battled uncertainties in the supply chain and managed diseases, they were concerned with prices and whether there would be buyers for their harvests.

There are many forecasts on shrimp demand in major markets. We believe that it is important to combine such information with shrimp supply scenarios directly from major producers in Asia and Ecuador."

Keynote speaker, George Chamberlain, President, Global Aquaculture Alliance, said, “The global shrimp supply has been on a rising trend for the last few years and at the same time, prices have been falling, indicating that markets were getting saturated in spite of the emergence of China as a major market in recent years.”

Citing the case of avocado as an example of what unified marketing efforts by the producers and sellers can achieve, Chamberlain called for a similar effort in which shrimp consumption is promoted.

Also read: Biotechnology Applications Without Antibiotics, Chemicals in Shrimp Culture

Demand and markets

In his introduction to the session on shrimp demand and markets, moderator, Ravi Yellanki, Vaisakhi Biomarine, said that the industry in India has come to terms with the reality of the Covid -19 pandemic. Industry, hatcheries in particular, have realised the global nature of shrimp farming; it starts with imports of broodstock from the Americas and exports of final products to the US, Europe and China.

The pandemic has changed the way hatcheries operate – staff are not allowed to leave the premises, farmers agree for hatcheries to send post larvae directly to laboratories for disease and health checks, and size specifications are checked via videos.

Demand from India’s leading markets has been encouraging; China was the first to recover and demand picked up in April, May and June. The demand from the food service segment was better in the US as compared to that in China.

In his presentation on the “Impacts in the US shrimp markets”, Angel Rubio, Chief Analyst at Urner Barry, said that retail sales of shrimp rose during the pandemic but still could not compensate for the lost sales in the food service segment. Prices of shrimp fell as a result but retail establishments passed the benefit of low prices to the consumers through promotions.

It is likely that the experience of cooking shrimp at home will encourage consumers to increase their purchase of shrimp in retail outlets even after the pandemic is over.

With regards to markets in Europe, Willem van der Pijl, who recently started Shrimp Insights, a data service specific to global shrimp trading, said that shrimp consumption in Europe was down by 6% up to June 2020, but the shrimp mostly impacted by this drop was the ocean-caught premium shrimp.

Farmed penaeid shrimp were much less affected at only 1%. Due to the opening of restaurants, the summer sales of shrimp are believed to have been healthy. “Although data is not yet available, during July and August, sales increased according to importers and wholesalers in the Netherlands, Belgium and Germany. However, the ongoing second wave of the pandemic points to the possibility of lockdowns during the winter and this would negatively impact consumption leading to less new orders between October and February/March 2021.

Vietnam and Latin American suppliers have a competitive position in the European markets requiring other Asian suppliers to reassess their competitiveness. Vietnam supplies more than 70% of the demand while India supplies just 5%,” said van der Pijl.

Vincent Lin of Grobest Seafoods said that China imported 703,000 tonnes of shrimp in 2019 but average prices were sliding downwards. In 2019, the surge in imports was led by Ecuador (321% at 322,000 tonnes); India (338% at 155,000 tonnes and Thailand (58% at 39,000 tonnes).

China has maintained an increasing trend of imports until January-February 2020. Demand picked up in June but dropped in July 2020 when fragments of coronavirus genetic materials were found on the packaging of shrimp imported from Ecuador. Consumer confidence was severely impacted and the import volumes and prices tumbled as a result.

Also read: Promising Results in Shrimp Fed Plant-Based Replacements for Fishmeal

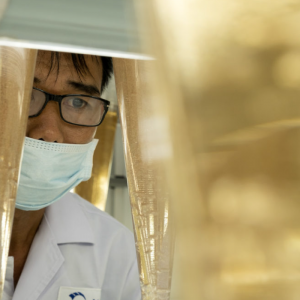

At the panel discussion on demand and markets on day 1, Dr Arul Victor Suresh, SAP President (middle row, left) led a team of SAP members and speakers. MPEDA’s Dr Anilkumar (last row, left) said that India increased its exports of cooked and breaded products to the US market indicating that Indian processors have the flexibility to meet the market requirements at short notice.

China’s shrimp production has been affected due to the emergence of new diseases, so local production will go down and be directed to the premium live shrimp market. Lin added that in the future, imports of some superior grade chilled or frozen head-on shell-on (HOSO) shrimp may enter this market.

Resumption of imports at or beyond volumes in 2019 will begin only when consumers gain confidence that frozen food is not a risk factor in the spread of coronavirus. India exports headless shell-on (HLSO) and there is room for India with good quality raw material for shrimp paste. Chinese consumers appreciate good quality shrimp and are willing to pay for quality.

Pawan Kumar Gunturu of Sprint Foods, India provided a perspective from Indian exporters. The sudden lockdown resulted in difficulties in operating processing plants and forced migrant workers to move back to their home bases. Indian exporters faced cancellations or postponement of purchase orders.

Decline in prices and cancellation of export incentives by the government have caused further hardships for the exporters. Gunturu showed that there has been an increase of 5% in value-added products from India.He added that India needs to build on its strengths and move into more value added products in the near future.

During the panel discussion, Dr P. Anilkumar, Marine Products Export Development Authority (MPEDA), indicated that Indian shrimp exports have declined by about 15% but the exports of cooked and breaded products to the US have registered an increase indicating that Indian processors have the flexibility to meet market requirements at short notice. S. Santhana Krishnan of Maritech, a seafood and aquaculture consulting firm, said that India’s ability to supply large sized shrimp can be leveraged to serve niche markets globally.

Also read: Prevention of Disease Caused by EHP Spores on Shrimp

Supply scenarios

Samson Li, Grobest Feeds CEO, and experts from leading shrimp producing countries discussed recent developments in Vietnam, Indonesia, India and Ecuador amidst this pandemic. Li remarked that supplies from Vietnam have not been severely affected due to the significant domestic market, and the sustained demand from the export markets.

Furthermore, strict control of the pandemic and sensible lockdown policies may have minimised the disruptions in supply. However, Vietnam may face a contraction in production, from 630,000 tonnes in 2019 to 570,000 tonnes in 2020. For the long term, Li predicted a strong growth and higher productivity through intensification which has been happening over the past two years, including a return to 2019 production levels in 2021 and from then on a 3% annual growth.

“Initially, Indonesia did not follow a strict lockdown,” said Haris Muhtadi, CJ Feeds who also described its intensive culture practices. “The first half of 2020 saw a slight production increase and export of shrimp when compared to the same period in 2019. Indonesia’s production in recent years reached close to 350,000 tonnes in 2019 and the production in the first six months of 2020 was estimated to be about 200,000 tonnes.

The USA remained the largest importer of Indonesian shrimp, buying nearly 65% of production.” Haris estimated that there may be a drop in production in the second half of the year due to disease challenges, and Indonesia may end up with a decline of about 6-7% in production by the end of the year.

According to Paresh Kumar Shetty of Avanti Feeds, the sudden and strict early lockdown in India, resulted in many disruptions affecting shrimp production and processing. Lower shrimp prices also dampened farmers’ spirits forcing early harvests of small shrimp (size 100140/kg). While the lockdown has been relaxed, labour availability continues to be an issue. Also, farmers are facing production challenges in many regions. As a result, Shetty said that India’s farmed shrimp production is likely to decrease to about 675,000 tonnes in 2020, from about 800,000 tonnes in 2019.

Gabriel Luna, an industry analyst in Ecuador's shrimp business elaborated on the phenomenal growth of shrimp production and exports in the past 10 years; exports grew 4X in 10 years, reaching 630,000 tonnes in 2019. By August 2020, the country had reached about 450,000 tonnes, a 6% year-on-year increase. This increase was despite the difficulties due to the lockdown and exports to China which was Ecuador’s largest market in 2019.

Farmers were unable to harvest their crops in April and May due to the lockdown, followed by disruptions in exports to China in July. Prices collapsed to historic lows as a result. “Fortunately, we could quickly increase sales to the USA and Europe and presently have achieved a good redistribution of markets. The decline in prices has affected profitability, “ said Luna, adding that Ecuador’s producers will seek to improve productivity not by expanding land area or intensification but by focusing on improvements in shrimp growth and survival, and profitability by going into niche markets, such as organic shrimp.

Panellists at the end of day 2, noted that shrimp supply from the major producing countries has not been seriously impacted by this pandemic and global supply of farmed shrimp may decline by about 10% in 2020 as compared to 2019. Global trade of shrimp has not been affected to a large extent except in the case of China. However, lower shrimp consumption in the US where the increase in retail sales has not been compensated for the loss of food service sales means that unsold inventories would be fairly high.

Further declines can be expected in the winter due to anticipated restrictions in restaurant operations. Shrimp prices have been negatively affected due to the disruptions from the lockdown as well as the loss of consumer confidence in China. While the low prices have been used to stimulate some of the consumption, the response in the major producing countries to low prices will drive future decisions on production, types of products, market focus, and farming technologies.

Watch a recording of this conference at the official SAP YouTube link, https://m.youtube.com/channel/UCzfxplVy8IFXP16iTvH_Lg

Source: Aquaculture Asia Pacific Magazine